At Greater Houston Community Foundation, we believe in the power of philanthropy to drive positive change in our community. As a donor, you have the opportunity to make a lasting impact by transforming assets, such as stocks, bonds, real estate, or business interests, into vital resources for charitable causes. With our expertise and personalized service, we can help you navigate the complexities of giving and maximize the effectiveness of your donation. Discover how you can unlock the potential of your holding assets to create meaningful change where it’s needed most.

Benefits

Donating privately held assets offers numerous benefits, including potential tax advantages, simplified giving, legacy preservation, and flexibility in choosing assets tailored to your philanthropic goals and financial situation.

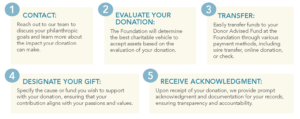

How It Works

As your trusted philanthropic partner, Greater Houston Community Foundation is dedicated to supporting your charitable aspirations and maximizing the impact of your generosity. By choosing to donate holding assets through us, you’re not only investing in the betterment of our community but also ensuring a lasting legacy of positive change. Our team is here to guide you every step of the way, providing personalized assistance, expert advice, and unparalleled service. Together, let’s harness the potential of your holding assets to create a brighter future for Greater Houston.